Purpose

Return value

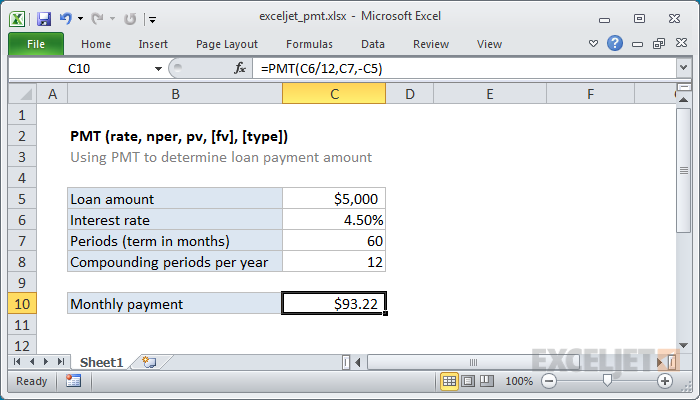

Syntax

=PMT(rate,nper,pv,[fv],[type])- rate - The interest rate for the loan.

- nper - The total number of payments for the loan.

- pv - The present value, or total value of all loan payments now.

- fv - [optional] The future value, or a cash balance you want after the last payment is made. Defaults to 0 (zero).

- type - [optional] When payments are due. 0 = end of period. 1 = beginning of period. Default is 0.

Using the PMT function

The PMT function can be used to figure out the future payments for a loan, assuming constant payments and a constant interest rate. For example, if you are borrowing $10,000 on a 24 month loan with an annual interest rate of 8 percent, PMT can tell you what your monthly payments be and how much principal and interest you are paying each month.

Notes:

- The payment returned by PMT includes principal and interest but will not include any taxes, reserve payments, or fees.

- Be sure you are consistent with the units you supply for rate and nper. If you make monthly payments on a three-year loan at an annual interest rate of 12 percent, use 12%/12 for rate and 3*12 for nper. For annual payments on the same loan, use 12 percent for rate and 3 for nper.