Purpose

Return value

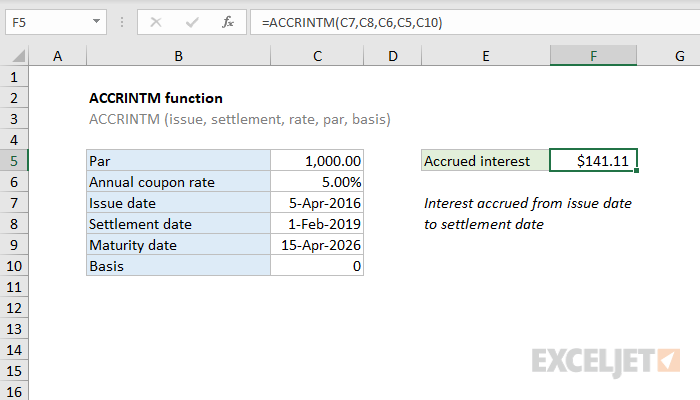

Syntax

=ACCRINTM(id,sd,rate,par,[basis])- id - Issue date of the security.

- sd - Settlement date of the security.

- rate - Annual coupon rate.

- par - Par value of security.

- basis - [optional] Day count basis (see below, default =0).

Using the ACCRINTM function

In finance, bonds prices are quoted "clean". The "clean price" of a bond excludes any interest accrued since the issue date, or most recent coupon payment. The "dirty price" of a bond is the price including accrued interest. The ACCRINTM function can be used to calculate accrued interest for a bond that pays periodic at maturity (i.e. only pays interest one time).

Date configuration

By default, ACCRINTM will calculate accrued interest from the issue date to the settlement date. If you want to calculate total interest from the issue date to the maturity date, supply maturity date instead of settlement date.

Example

In the example shown, we want to calculate accrued interest for a bond with a 5% coupon rate. The issue date is 5-Apr-2016, the settlement date is 1-Feb-2019, and maturity date is 15-Apr-2026. We want accrued interest from the issue date to the settlement date. The formula in F5 is:

=ACCRINTM(C7,C8,C6,C5,C10)

With these inputs, the ACCRINTM function returns $141.11, with currency number format applied.

Entering dates

In Excel, dates are serial numbers. Generally, the best way to enter valid dates is to use cell references, as shown in the example. To enter valid dates directly inside a function, you can use the DATE function. To illustrate, the formula below has all values hardcoded. The DATE function is used to supply each of the two required dates:

=ACCRINTM(DATE(2016,4,5),DATE(2019,2,1),0.05,1000,0)

Basis

The basis argument controls how days are counted. The ACCRINTM function allows 5 options (0-4) and defaults to zero, which specifies US 30/360 basis. This article on wikipedia provides a detailed explanation of available conventions.

| Basis | Day count |

|---|---|

| 0 or omitted | US (NASD) 30/360 |

| 1 | Actual/actual |

| 2 | Actual/360 |

| 3 | Actual/365 |

| 4 | European 30/360 |

Notes

- In Excel, dates are serial numbers.

- All dates, and basis, are truncated to integers.

- If dates are invalid (i.e. not actually dates) ACCRINTM returns #VALUE!

- ACCRINTM returns #NUM when:

- issue date >= settlement date

- rate < 0 or par <= 0

- Basis is out-of-range