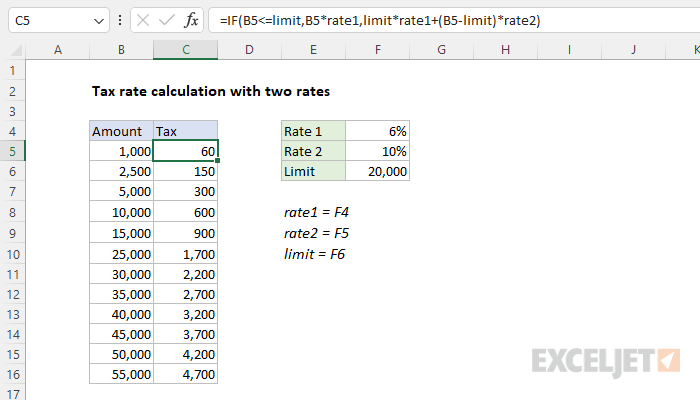

Explanation

The goal is to calculate a tax of 6% on amounts up to 20,000 and a tax of 10% on amounts of 20,000 or greater. This problem illustrates how to use the IF function to return different calculations. At the core, this formula uses a single IF function. The logical test is based on this expression:

B5<=limit

When B5 (the current amount) is less than the limit in cell F6 (20,000), the test returns TRUE and the IF function applies rate1 only:

B5*rate1

When B5 is greater than 20,000, the test returns FALSE and the IF function applies rate1 and rate2:

limit*rate1+(B5-limit)*rate2

Translation:

- Calculate rate1 by multiplying the limit (20,000) by 6% (F4).

- Calculate rate2 by subtracting the limit from the amount, and multiplying the result by 10% (F5)

- Add #1 and #2 together

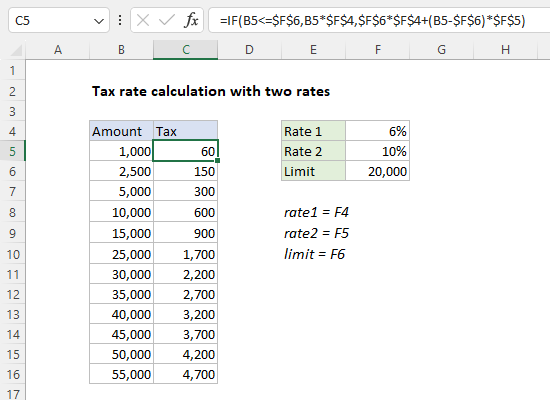

Without named ranges

Named ranges can make formulas easier to write and read. The same formula without named ranges looks like this:

=IF(B5<=$F$6,B5*$F$4,$F$6*$F$4+(B5-$F$6)*$F$5)

References to F4, F5, and F5 are locked to prevent changes when the formula is copied down the table. Notice B5 is still a relative reference because we want the reference to change as the formula is copied.