Purpose

Return value

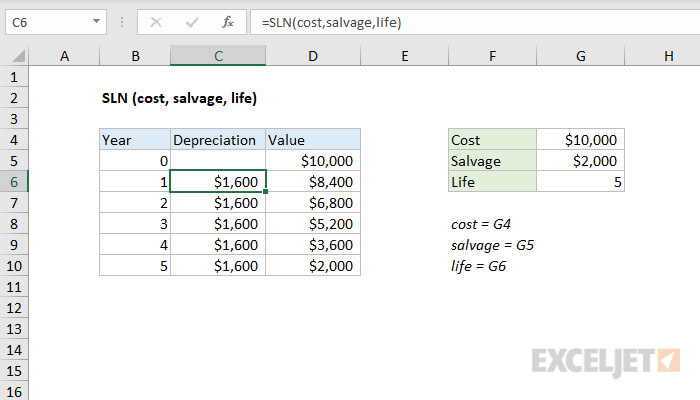

Syntax

=SLN(cost,salvage,life)- cost - Initial cost of asset.

- salvage - Asset value at the end of the depreciation.

- life - Periods over which asset is depreciated.

Using the SLN function

The Excel SLN function returns the depreciation of an asset for one period, calculated with a straight-line method. The calculated depreciation is based on initial asset cost, salvage value, and the number of periods over which the asset is depreciated.

For example, for an asset with an initial cost of $10,000, a useful life of 5 years, and a salvage value of $2,000:

=SLN(10000,2000,5) // returns $1600

In the example shown, the formula in C6, copied down, is:

=SLN(cost,salvage,life)

where named ranges are defined as follows:

cost = G4

salvage = G5

life = G6