Purpose

Return value

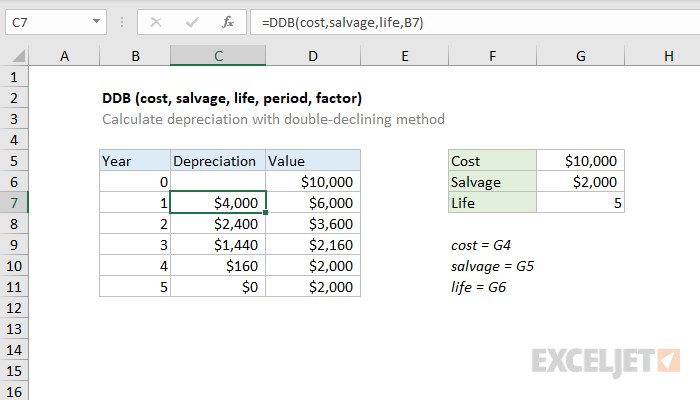

Syntax

=DDB(cost,salvage,life,period,[factor])- cost - Initial cost of asset.

- salvage - Asset value at the end of the depreciation.

- life - Periods over which asset is depreciated.

- period - Period to calculation depreciation for.

- factor - [optional] Rate at which the balance declines. If omitted, defaults to 2.

Using the DDB function

The DDB function calculates the depreciation of an asset in a given period using the double-declining balance method. The double-declining balance method computes depreciation at an accelerated rate – depreciation is highest in the first period and decreases in each successive period. To calculate depreciation, the DDB function uses the following formula:

=MIN((cost-pd)*(factor/life),(cost-salvage-pd))

where pd = total depreciation in all prior periods.

The factor argument is optional and defaults to 2, which specifies the double-declining balance method. You can change factor to another value to influence the rate of depreciation. This is why DDB is sometimes defined as "double-declining method" or "other method". In the example shown, the formula in D7 copied down, is:

=DDB(cost,salvage,life,B7)